Have you heard what happened during the last episode of Succession?

According to what I read in Strategy Magazine over the weekend, the legendary Noel O’Dea is handing the keys to independent agency Target over to Catherine Kelly. The 45-year-old agency is living proof that the “world needs more Newfoundland,” and Kelly is the right person for the job, according to O’Dea after her twenty-five years with the agency.

Not the Succession story you were expecting from me?

Were you hoping to hear more about my handing the reins of T1 over to Liz Rose and Nithya Ramachandran on January 1st? How have the two of them and the entire T1 Leadership Team seamlessly transformed our business into a complete stack sponsorship innovator bleeding strategy, activation, and amplification for impactful brands?

Hmm. I suspect I am at two strikes, and what you came here for is my hot take on the HBO hit – Succession. Well, I will not scream “I LOVE it” at the top of my lungs as I only watched one episode, the finale, and I can’t say it had me wanting to go back for more.

One of the reasons the show is so successful is that the topic of Succession is one that many of us can relate to. Even those without a business background may have gone through legacy-like situations, including dealing with estate planning, will probates, or even less significant moments, such as who will run the office sports pool.

But really, how many of us can relate to being billionaires?

In entrepreneurship, there are at least three sides to every Succession. First is the incumbent, often the person or persons who started the operation. Second, are the candidates, those who want to ascend to and perceive they have a shot at the throne. Then there are the masses jockeying for position, casting and recasting their support while fretting over their future.

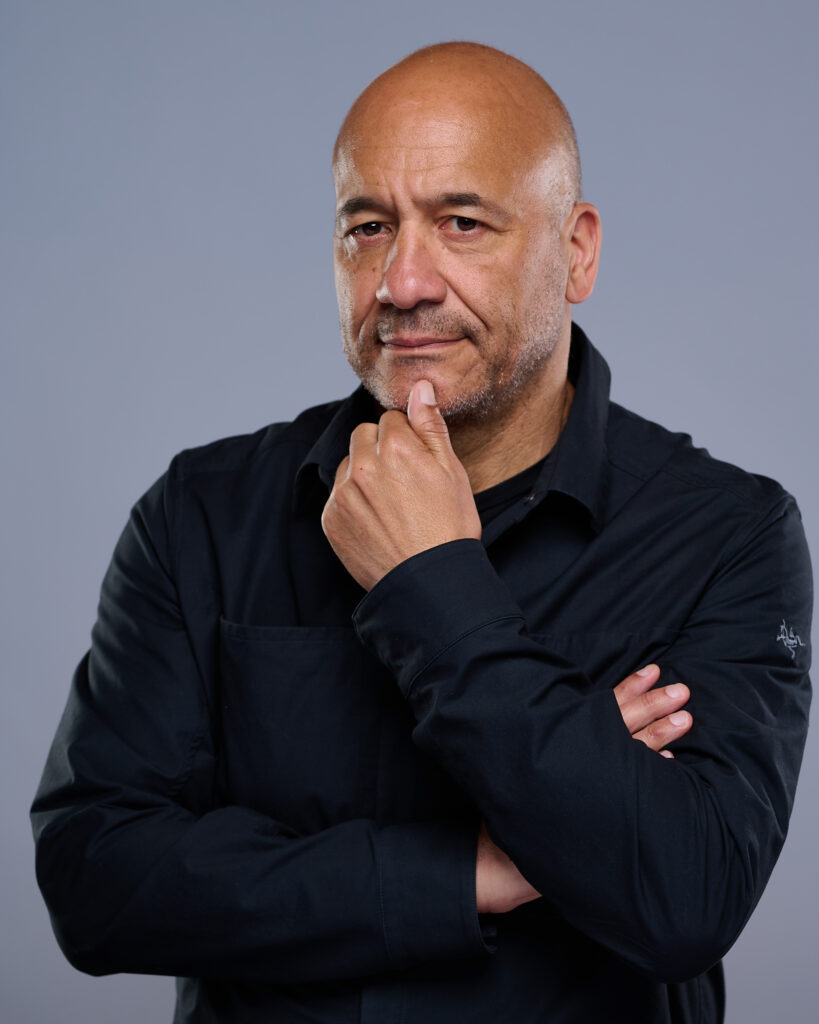

I am in the middle of my Succession and very happy to report it is far from a soap opera. It has been purposeful and intentional and not designed to attract the ratings that an HBO series does. In one respect handing the reins of T1 over has been easier than I imagined because it didn’t coincide with my retiring or exiting the industry. I now focus on business development, networking, future-proofing, and storytelling, to borrow a word from Noel.

However, it has been challenging, and there are some things you need to consider if Succession is on the horizon for you. First and foremost, you must find or develop new self-control muscles and habits you had never previously possessed. This new self-control applies to the small everyday items even more than the big decisions. You will have to learn to let the multiple occasions that occur daily go by without fretting over them. For example, the shades of these balloons may have been your favourite decision to make at past company events, and you may still have the itching; however, your comments on them will be perceived as your inability to put a lid on your hot air.

Who gets hired, who gets fired, who gets paid what? The more significant issues that are very important to the organization you relinquish is how you adapt to not weighing in on them. If choices are being made you disagree with, consider that progress towards the transformation of a company that will be even more fit for the future.

The relinquishing of control is made more accessible through many conversations, frank discussions about value, and a lockstep alignment around financials. Especially financials. Being an entrepreneur is not a fantasy. It can be gratifying, life-changing, and society-making. However, these outcomes can only be achieved if the venture is sustainable and viable. Having a stake in the game is what separates the person who is entrepreneurial from the entrepreneur. This is a tricky tightrope in a succession exercise, mainly when commitment or investment mismatches occur.

In a direct line succession where the new regime has bought out the founders, there is usually less tension around the financials if the financial commitment of purchase has been satisfied. This, too, can become complicated when an additional earnout is in place for the founders or if the seller is financing the buyer. This can be an area of friction in situations even where this is well-documented.

Legacy, reputation, and brand are the most emotional components of any succession process. Often founders feel that the acquiring or succeeding group needs to provide more value or care to clients and customers than they do. This can be exasperating in some situations, to the point where some founders will try to complete their earnout period on an accelerated base. If not, abandon it altogether. It is hard for them to watch someone else mistreat their baby.

As you have been reading this, you may be ready to argue that even a local business succession event could have much of the same drama as a TV show. The well-written script of the transition process is apt to be stained by emotion and tension that inevitably comes through in something so central to human survival.

Who knows. HBO may need a Succession capsule on Survivor to keep as an epilogue. Or maybe I shouldn’t make these suggestions, as I have never seen an episode of Survivor either.